Call us on: 01245 379977

Contact us today for your FREE quote.

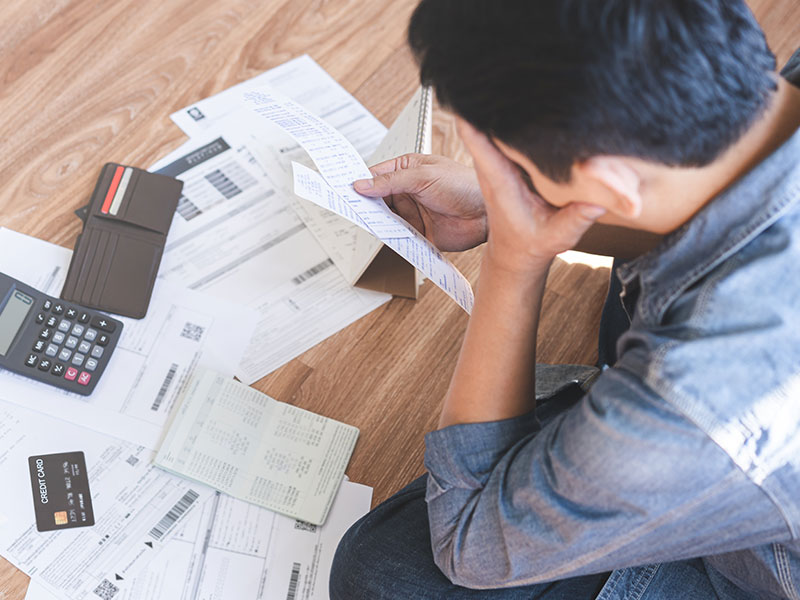

At Lightbulb Lending, we know that life can sometimes take unexpected turns which lead to financial difficulties. Financial issues such as Individual Voluntary Arrangements (IVAs) or bankruptcy can be challenging, but they shouldn’t prevent you from achieving your goal of homeownership. We are experts in finding mortgages for clients with impaired credit and are here to help you secure a mortgage, no matter your financial history. Contact us today for your FREE consultation.

Mortgages with an IVA or Bankruptcy Are Still Possible

Securing a mortgage when you have an IVA or bankruptcy is within your reach with help and guidance from Lightbulb Lending. We work with specialist lenders who understand that life events can impact your credit score. We’re here to make your dream home possible.